Division 7a Loan Agreement Template

If a company were to loan money to a shareholder or associate without a Division 7A agreement the amount may be counted towards the individuals income for that tax year. LawLive publishes online contracts and legal documents for Australian businesses.

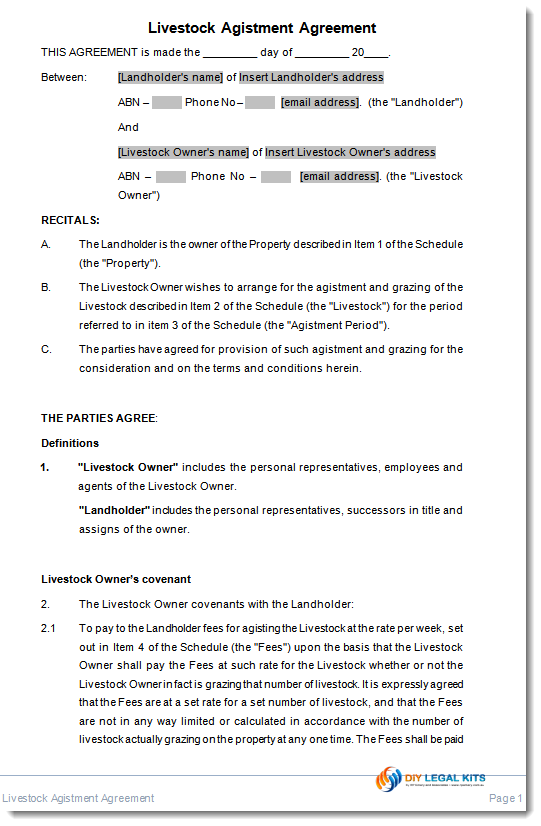

Agistment Agreement Contract Livestock Animals

Agistment Agreement Contract Livestock Animals

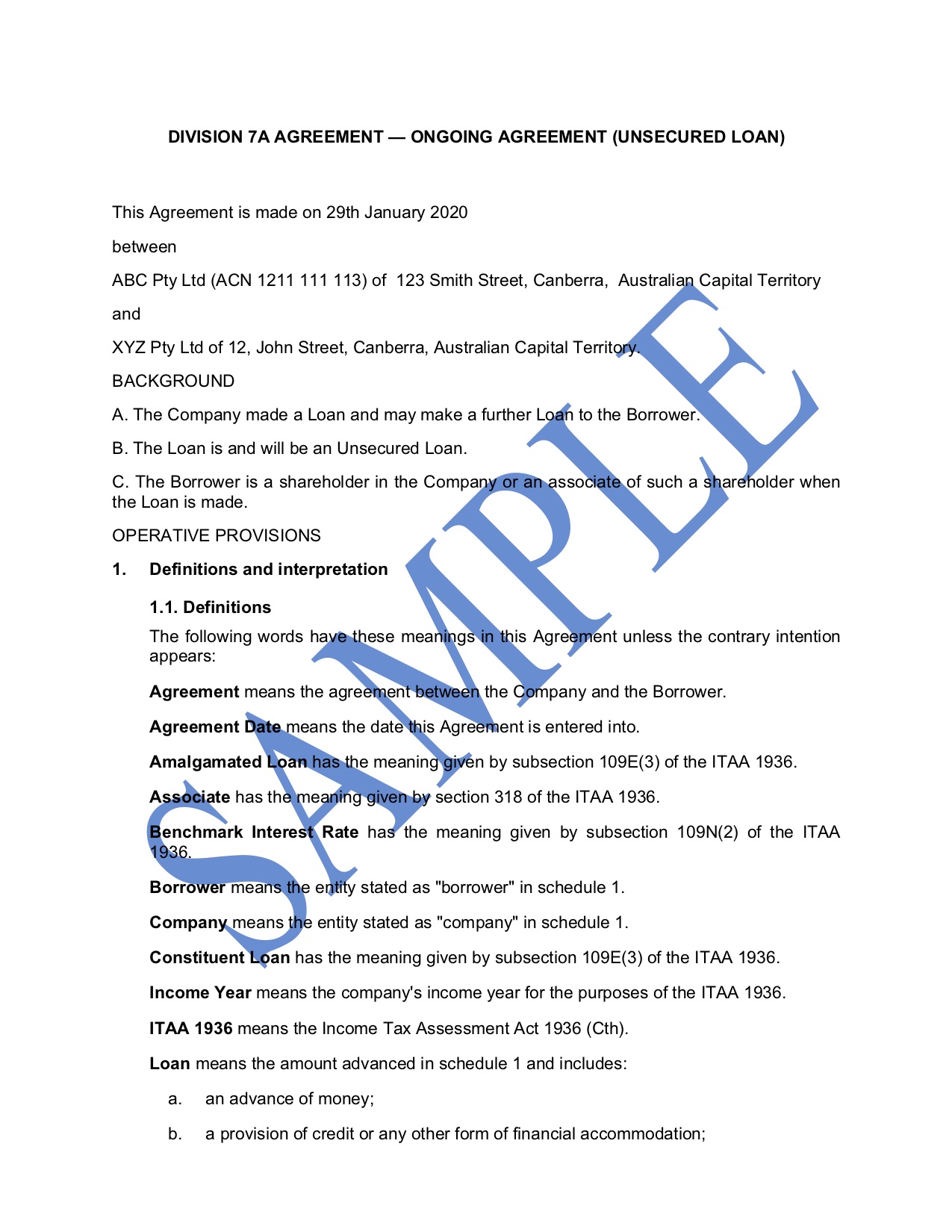

Our Div 7A company loan agreement is a formal agreement prepared and signed by the company and the borrower.

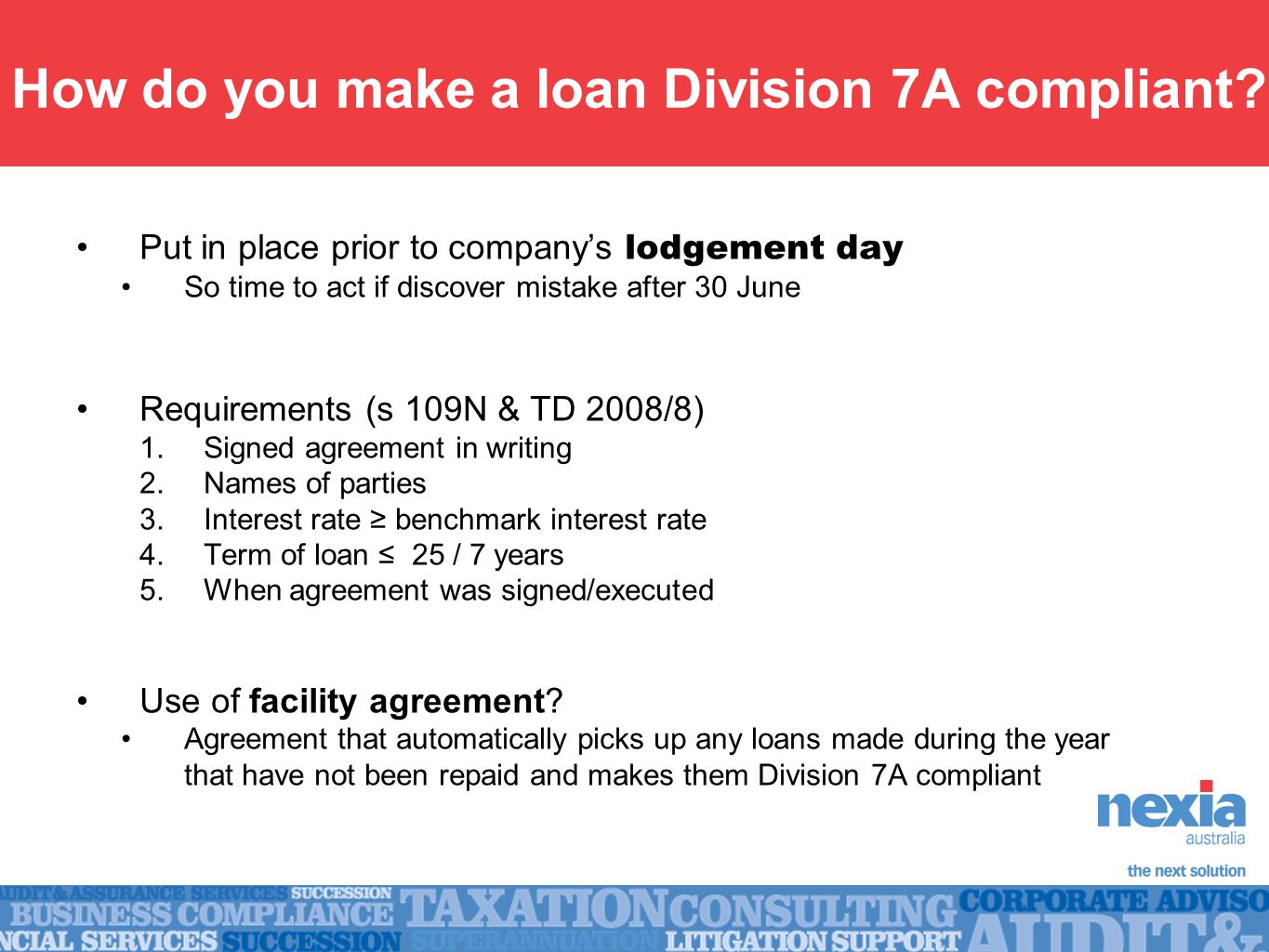

Division 7a loan agreement template. This is a Sydney based company and was founded in 2006. Additionally the parties must sign and date the loan agreement before lodging the private companys tax return. Your professionally drafted easy to use Division 7A Company Loan Agreement is available for.

Division 7A Loan Agreement Template. To learn more about the operation of Division 7A visit Private Company Benefits Division 7A dividends. Division 7A Loan Agreement Template Ato 7.

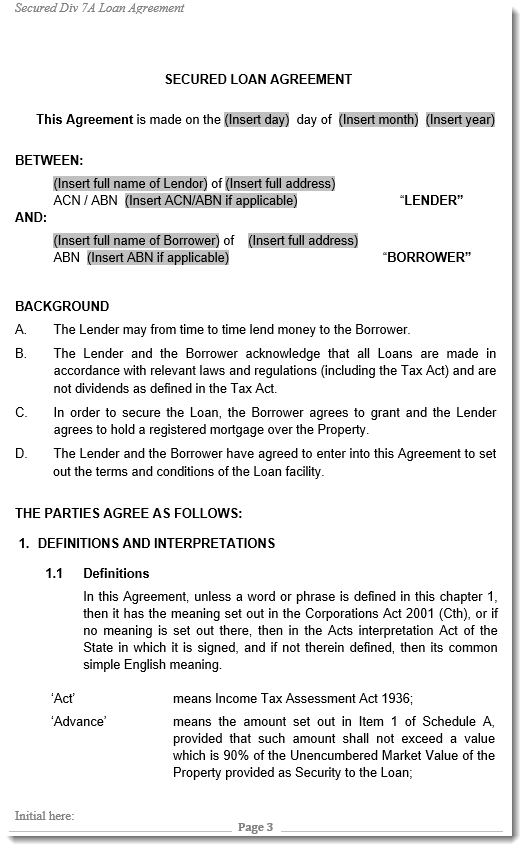

It ensures compliance under section 109N of the Act and protects your company from being deemed by the ATO to have given money to the borrower. LawLive Australia provides the Division 7A Loan Agreement Template in Microsoft Word format so its easy to make edits after you download it. A Division 7A Loan Agreement is a document that formalises loans between a private company and an individual.

Edit with Office GoogleDocs iWork etc. Division 7A Loan Establishment Kit This Kit has been prepared by Maddocks. More About LawLive Australia.

The aim of Division 7A of the Income Tax Assessment Act 1936 the Act is to prevent privately held companies from making tax-free distributions of profits to its directors and shareholders in the form of loans. A Division 7A loan agreement is a legal document required of private companies Pty Ltd to prevent them from making tax-free profits by distributing funds to their shareholders and associates. Where the parties believe that division 7A applies to the Loan they may wish to use an alternative agreement the Division 7A Loan Agreement.

In order to establish the first annual minimum repayment the amount of the merged loan not repaid at the end of the 2014 income year is 55000 loans less repaid before the date of return for fiscal 2014 and the benchmark interest rate for the year ended June 30. A loan agreement under Division 7A cannot be longer than 7 years. This is the Division 7A loan agreement to be used where the company is lending to a single borrower who is a natural person and that person is a director shareholder or associate of a director or shareholder of the.

The Division 7A calculator and decision tool has two main components to help you determine the effect of Division 7A in relation to payments loans or debt forgiveness and how to meet your obligations on complying loans. A Division 7A loan agreement is a loan agreement that covers certain payments or loans that are made or debts that are forgiven by a private ie. Over 2000 Essential Templates to Start Organize Manage Grow Your Business in 1 Place.

If you are using mobile phone you could also use menu drawer from browser. Division 7A is intended to prevent companies from making tax-free distributions to shareholders. Without a Division 7A loan agreement these payments or loans would for tax purposes be treated as assessable income of the recipient.

Ad Download Template Fill in the Blanks Job Done. Agreement from company to shareholders that satisfies requirements of a loan under Division 7A of the income Tax Assessment Act 1936. A Division 7A loan agreement covers certain payments loans and debts made by and forgiven by a private company Pty Ltd.

A division 7A loan agreement is a contract between a private company Lender and a director or shareholder Borrower that satisfies the conditions contained in section 109N. Division 7A of the Income Tax Assessment Act 1936 Cth prevents private companies. The Division 7A loan agreement enables you to satisfy these requirements so that your loan is legitimate in the eyes of the ATO.

By admin In Uncategorized Posted December 7 2020. Understanding the loans purpose The Cleardocs division 7A loan agreement Loan Agreement is a loan agreement under which a company or the trustee of a trust associated with the company can make loans to shareholders or. Dont forget to bookmark Division 7A Loan Agreement Template using Ctrl D PC or Command D macos.

Division 7A does not apply to public companies. However a loan secured by real property may exempt a shareholder from this condition. Proprietary limited company and would otherwise be treated for tax purposes as assessable income of the recipient.

For the following performance years it is important to calculate the amount of the loan not repaid until the end of the previous. Whether its Windows Mac iOs or Android you will be able to. Dezember 2020 serano Allgemein 0.

Plus 1 this Document. Division 7A Loan Agreement Template. The minimum annual repayment must be established for each year of income after the year in which the loan is granted.

Division 7A Company Loan Agreement Template. If a Lender is a company and the Loan is being provided to a shareholder of that company parties should be aware of division 7A of the Income Tax Assessment Act 1936 Cth. Division 7A Loan Agreement Template.

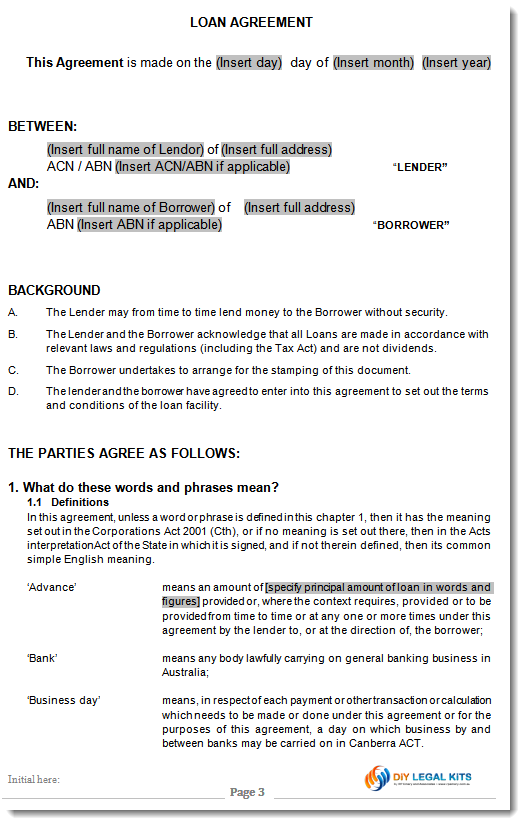

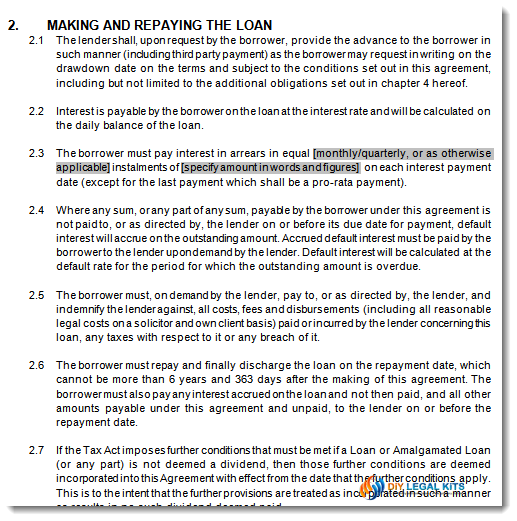

Loan Agreement Sample Template Online Word And Pdf

Loan Agreement Sample Template Online Word And Pdf

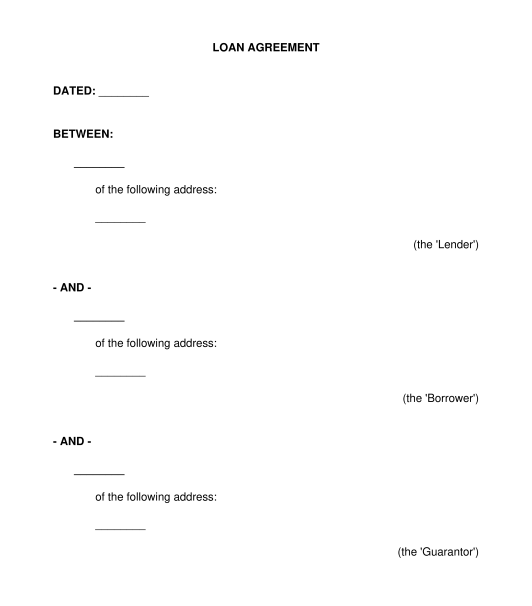

Unsecured Loan With Guarantee Agreement

Unsecured Loan With Guarantee Agreement

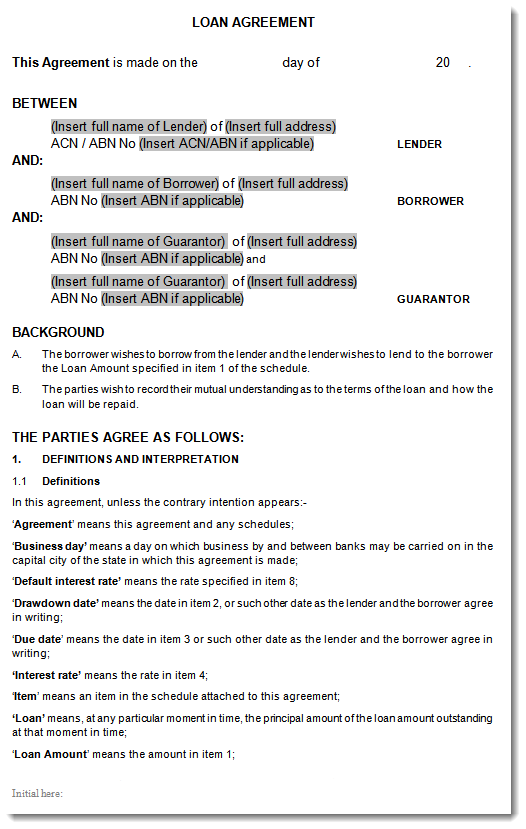

Division 7a Div7a Company Loan Agreement Template

Division 7a Div7a Company Loan Agreement Template

Fillable Online Application Form Division 7a Compliant Facility Agreement Fax Email Print Pdffiller

Fillable Online Application Form Division 7a Compliant Facility Agreement Fax Email Print Pdffiller

Division 7a Div7a Company Loan Agreement Template

Division 7a Div7a Company Loan Agreement Template

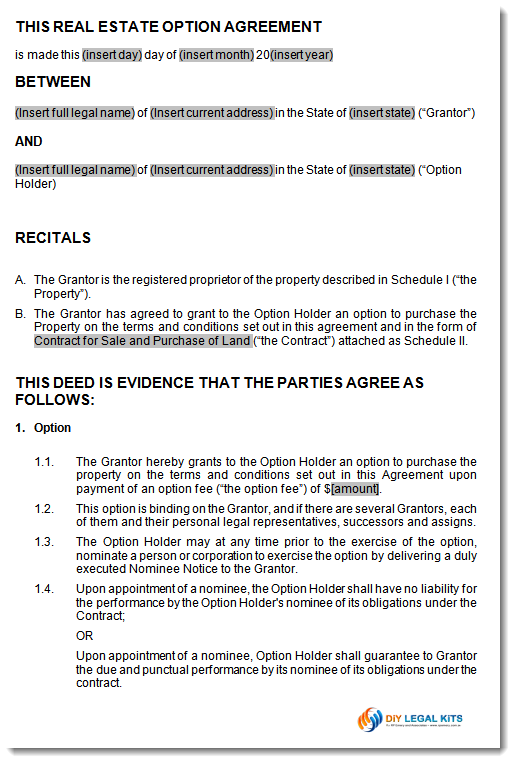

Option To Buy Real Estate Agreement Contract

Option To Buy Real Estate Agreement Contract

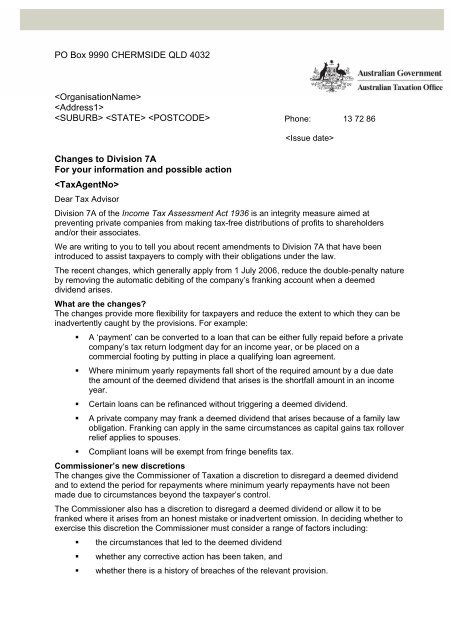

Sample Letter Australian Taxation Office

Sample Letter Australian Taxation Office

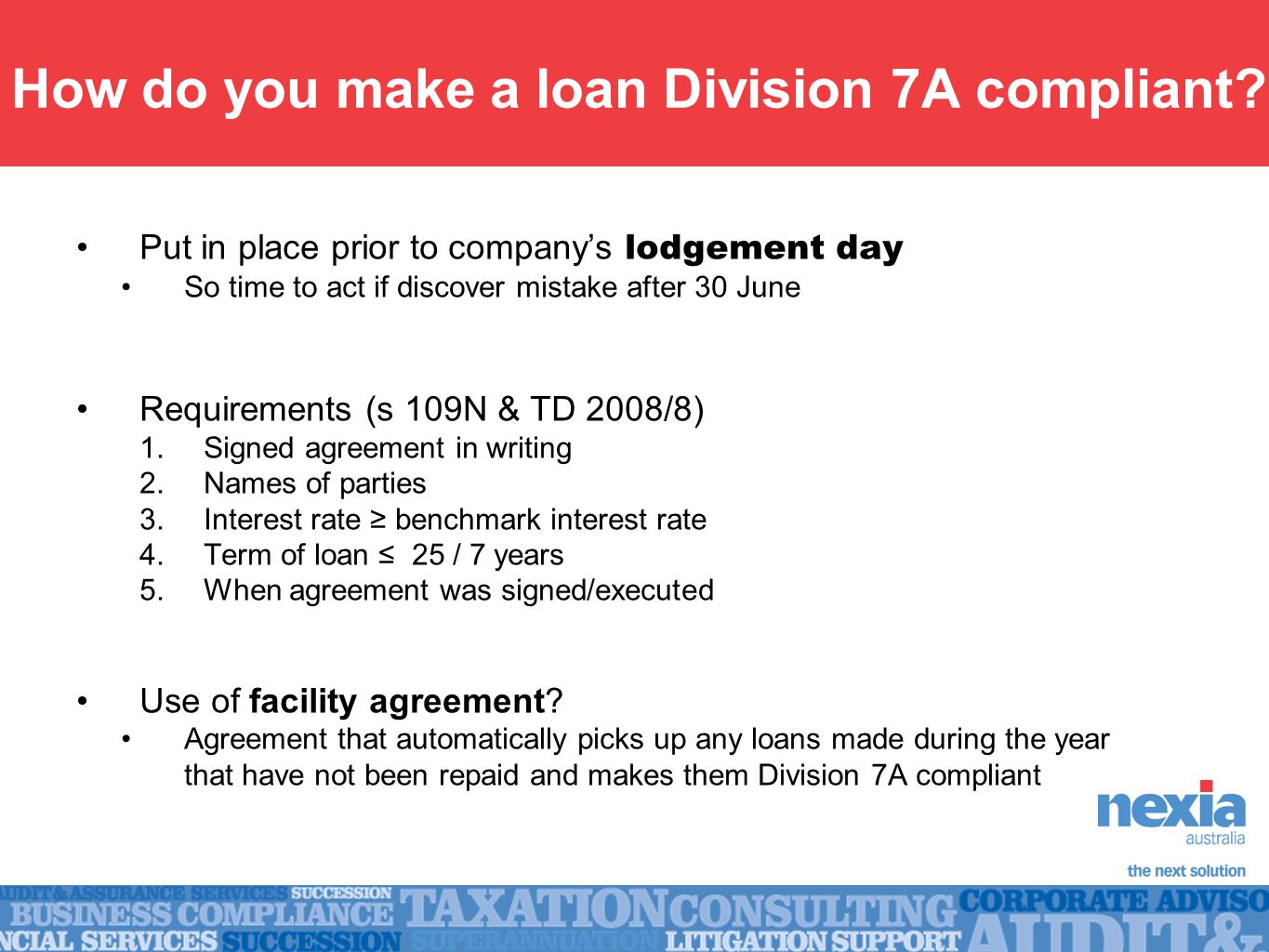

Division 7a Quarterly Roadshow Business Services Discussion Ppt Download

Division 7a Quarterly Roadshow Business Services Discussion Ppt Download

Division 7a Company Loan Agreement Template

Division 7a Company Loan Agreement Template

Division 7a Loan Agreement Free Template Sample Lawpath

Division 7a Loan Agreement Free Template Sample Lawpath

Loan Agreement With Interest Free Template Sample Lawpath

Loan Agreement With Interest Free Template Sample Lawpath

Division 7a Company Loan Agreement Template

Division 7a Company Loan Agreement Template

Division 7a Company Loan Agreement Template

Division 7a Company Loan Agreement Template

0 Response to "Division 7a Loan Agreement Template"

Post a Comment